Money Savvy Kids

Teaching children the value of money is a vital aspect of their development. By instilling a strong understanding of earning, saving, and budgeting, you'll set them up for long-term financial stability and success. Here are some valuable tips to introduce your kids to the concept of money management:

Earning Money Requires Effort

Help your child understand that money doesn't magically appear. Explain that hard work, dedication, and education are essential for earning a good income.

Prioritizing Spending

Teach your child the importance of budgeting and prioritizing their spending. Encourage them to categorize their needs and wants, and to stagger their spending throughout the month.

Setting Financial Goals

Introduce the concept of a wish list, where your child can prioritize their wants and needs. This helps them understand the value of delayed gratification and saving for something they really want.

Delayed Gratification

Teach your child the benefits of waiting and saving for something they want. This helps them develop self-discipline and appreciate the value of their purchases.

Savings and Banking

Open a savings account for your child to help them understand how their money can grow over time. Encourage them to save regularly and plan ahead for the future.

Teaching children the value of money from a young age is crucial for their future financial stability and success. By instilling good money habits early on, kids can develop a healthy relationship with money, make informed financial decisions, and understand the importance of saving. This is especially important in South Africa, where the savings rate has been alarmingly low.

So, where do you start, and when? This guide provides practical tips and key lessons tailored to different age groups, helping you lay the foundation for your child's financial literacy.

Preschoolers

At this age (age 3 - 5), children are growing into curious and imaginative learners, beginning to understand the world around them. They're developing essential social and emotional skills, like sharing and taking turns, which lay the foundation for future financial values like generosity and responsibility.

As they start to grasp basic number concepts, it's an ideal time to introduce fundamental money skills, like recognizing coins and understanding that money is used to buy things.

Introducing the concept of money: Start by explaining that money is used to buy things. Use everyday situations, such as shopping, to illustrate how money is exchanged for goods and services. Emphasize the value of coins and notes.

Understanding value: Teach your child that different items have different prices. Use play money to demonstrate how to compare prices and make informed purchasing decisions. This helps kids prioritize spending based on value and cost.

Recognizing the value of different denominations: Help your child understand that different denominations represent different values. Play games where they trade coins for notes of equivalent value to reinforce this concept.

Activities to reinforce these lessons:

Toy Store Play: Use play money and a toy cash register to simulate shopping experiences.

Savings Jar: Create a simple savings jar and explain the concept of saving money for future use. Encourage your child to save coins for small treats.

Early Elementary

Early elementary schoolers (age 6 – 8) are becoming more independent, confident, and eager to learn. They're developing critical thinking skills, problem-solving abilities, and a sense of responsibility. As they begin to understand basic math concepts, like addition and subtraction, it's essential to teach them how to apply these skills to real-life financial situations, like earning, saving, and spending.

Earning Money

Introduce the concept of earning money through completing chores or small tasks. Explain that, just like adults, children can earn money by working hard. Establish a system where your child can earn a weekly or monthly allowance by completing age-appropriate chores, such as:

- Making their bed

- Helping with laundry

- Tidying up their toys

- Assisting with pet care

This approach teaches children the value of hard work, responsibility, and accomplishment. Ensure clear guidelines and consistent rewards to help them grasp the direct relationship between effort and earning.

Saving and Spending

Teach children the importance of saving a portion of their earnings and spending wisely. Encourage them to allocate their allowance into categories:

- Savings

- Spending

- Giving (charity)

Utilize visual tools like jars, envelopes, or a piggy bank to help them visualize where their money is going. Discuss:

- Short-term versus long-term savings goals (e.g., saving for a toy versus a bigger purchase)

- The benefits of saving money (e.g., affording more expensive items, avoiding impulsive spending)

- Making thoughtful choices with spending, understanding that money is a limited resource

Activities

Chore Chart with Allowance: Create a chore chart where each completed task earns a small allowance. Discuss how to allocate earnings between saving and spending.

Goal-Oriented Savings: Help your child set a savings goal, like buying a specific toy. Use a visual chart to track progress and celebrate when they reach their goal.

Play Store: Set up a pretend store with play money and items for sale. Practice making change, calculating costs, and making purchasing decisions.

Savings Jar Labels: Label jars or containers for different savings goals (e.g., short-term, long-term, charity). Encourage your child to allocate their savings accordingly.

Earning and Saving Scenarios: Engage your child in scenarios where they have to make decisions about earning and saving money. For example, "If you earn R10 for walking the dog, how much will you save and how much will you spend?"

Older Elementary & Pre-Teens

Older elementary schoolers (age 9 – 12) are growing into more analytical thinkers, developing their critical thinking skills, and forming opinions about the world.

They're beginning to understand more complex financial concepts, like comparison shopping and budgeting. As they enter pre-teen years, it's crucial to teach them how to make informed financial decisions, prioritize spending, and develop healthy attitudes towards money.

Pre-Teens (Ages 11-13) are transitioning into young adolescents, developing their identities, and forming relationships with peers.

They're becoming more aware of social and cultural influences on financial decisions. As they enter early adolescence, it's essential to teach them more advanced financial concepts, like earning, saving, and investing, while emphasizing the importance of responsible financial decision-making.

One effective way to foster this understanding is through comparison shopping.

Engage your child in the process by:

Reading price labels together: Examine the prices, sizes, and bulk amounts per unit.

Comparing products: Evaluate the quality and features of different brands or generic options.

Making informed decisions: Discuss the differences and decide together whether the extra cost of a brand-name product is justified.

Budgeting Fundamentals

Introduce your child to basic budgeting skills to manage their allowance effectively. Explain the concept of a budget and its importance in making informed financial decisions.

Help your child create a simple budget that outlines their:

- Income (allowance)

- Expenses (needs and wants)

- Savings goals

Teach them to categorize expenses, allocate their allowance wisely, and set aside a portion for savings and unexpected expenses. Use real-life examples to illustrate the benefits of budgeting.

Avoiding Impulsive Purchases

Teach your child the benefits of bargain hunting versus impulse buying. Explain the concept of delayed gratification and how it can lead to more satisfying purchases.

Encourage your child to set savings goals for larger purchases and create a plan to reach those goals. Discuss the advantages of waiting, including affording better quality items or saving for more important things.

Activities

Budgeting Workbook: Create a budgeting workbook with your child to track their income and expenses.

Savings Account Management: Open a savings account in your child's name and teach them how to manage it effectively.

Budgeting Games: Engage your child in budgeting games or simulations to practice making financial decisions.

Real-Life Budgeting: Involve your child in real-life budgeting decisions, such as planning a family outing or creating a grocery list.

Savings Challenges: Encourage your child to participate in savings challenges, such as saving a portion of their allowance for a set period.

Financial Goal Setting: Help your child set financial goals, such as saving for a specific item or experience.

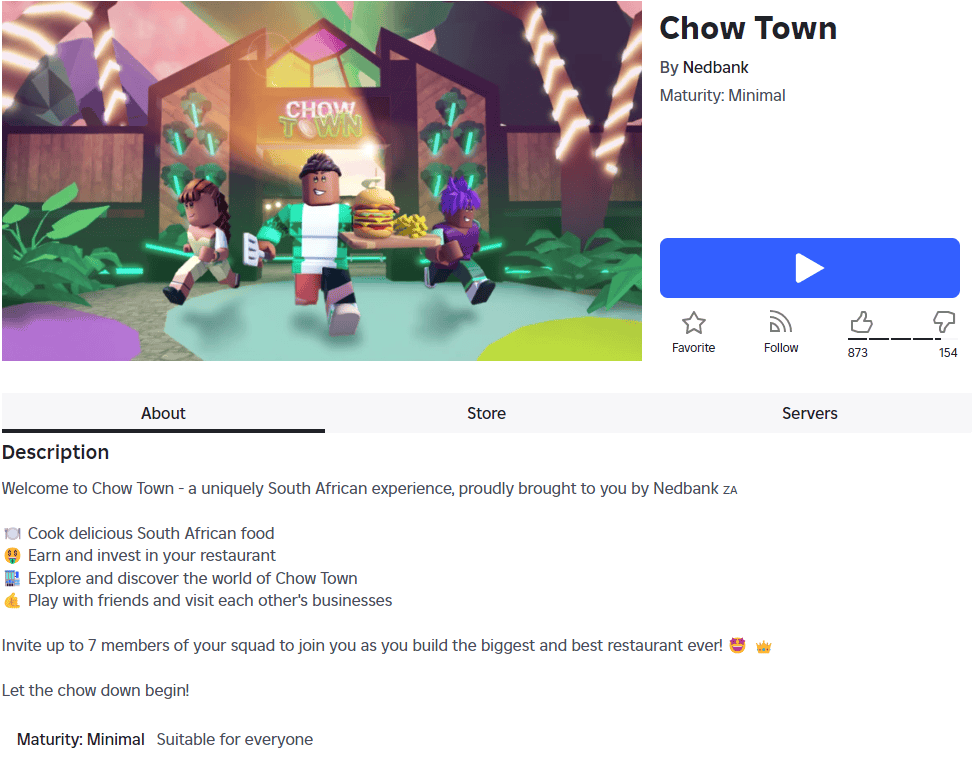

Budgeting Apps: Explore budgeting apps designed for kids, such as "Bankaroo" or "PiggyBot", to help them track their expenses and stay on top of their finances. Another fun app to consider is the Chow Town game that was launched by Nedbank, below.

If you prefer a digital approach, online strategy games are surprisingly useful learning tools. Players must first earn or gather resources before they can spend them on various items that help them progress in the game. Different assets and abilities are more effective at different levels of the game, so they teach kids to consider their spending and prioritise their most urgent needs carefully.

Chow Town, a collaboration between Nedbank and Sea Monster Entertainment on the popular Roblox gaming platform, is a game for kids aged 9 to 12 that teaches financial and business skills. While enjoying the fun of building a restaurant business from scratch, children also learn valuable money lessons. (Source)

Teenagers

Teenagers (age 14 – 18) are emerging into young adults, developing their independence, and preparing for post-secondary education or the workforce. They're facing increased financial responsibilities, like managing part-time job income, and making decisions about post-secondary education.

As teenagers enter the workforce through part-time jobs, internships, or other means, it's crucial to educate them on effective income management. Key lessons include:

Income Management Essentials

Teach your teenager to track their spending, identify areas for savings, and set aside a portion of their earnings for future goals, such as college or a car. Introduce the concept of taxes, explaining how deductions impact take-home pay.

Long-Term Planning Strategies

Introduce concepts like investing, credit, and financial responsibility. Expand their financial knowledge to include:

- Investing basics: Explain how investments like stocks, bonds, and mutual funds can grow their money over time.

- Financial responsibility: Teach budgeting for larger life goals, such as higher education, buying a home, or retirement.

- Credit management: Explain the difference between good debt (e.g., student loans) and bad debt (e.g., high-interest credit card debt).

Activities

Income Tracker: Help your teenager create a detailed income tracker to monitor their earnings and expenses.

Budgeting Simulator: Engage your teenager in a budgeting simulation to practice making financial decisions.

Investment Research: Conduct research on different investment options together, discussing risks and benefits.

Credit Score Education: Teach your teenager about credit scores, their importance, and how to maintain a good credit history.

Debt Management Scenario: Create a scenario where your teenager has to manage debt, making decisions on repayment terms and interest rates.

Financial Goal Setting: Help your teenager set financial goals, creating a plan to achieve them.

Real-Life Budgeting: Involve your teenager in real-life budgeting decisions, such as planning a family vacation or creating a grocery list.

Play to prosper: Money Lessons from Video Games

Play to prosper: Money Lessons from Video Games

As a parent, it can be frustrating to see your kids always glued to their devices. You might worry that they’re missing out on parts of their childhood that children enjoyed before technology was a constant companion. But if you shift your mindset a little, you can start to see tablets and smartphones not as ways to replace traditional childhood experiences, but rather to enhance them.

Read the Nedbank article HERE

Tips for teaching children how to save from a young age

The best way for children to learn good financial habits is to watch you - their parents – because your own approach to money management will stay with them throughout their lives. By teaching your children to budget and to be disciplined when it comes to saving for the things they want, you’ll be setting them up for a future of financial freedom.

Read the Old Mutual article HERE